Investors fled UK equity funds in 2023 at an unprecedented rate, as the sector suffered its worst year ever for withdrawals. Morningstar data shows that funds domiciled in the UK experienced net outflows of £25.7 billion by the year-end.

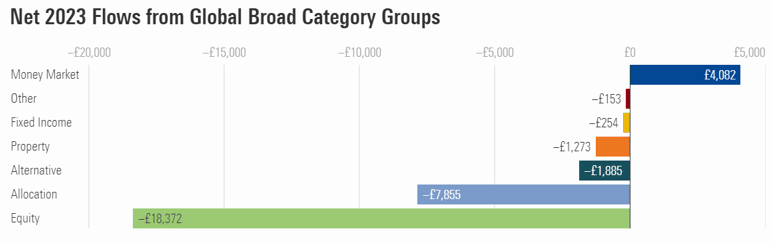

The bulk of these outflows came from equity funds, which lost £18.4 billion in assets. Equity funds did not see any net inflows in any month of 2023, underscoring the low appetite for UK-focused equity funds among investors.

According to AJ Bell’s Head of Investment analysis Laith Khalaf, UK equity funds have been hemorrhaging money since 2016.

“Over eight years of pain, more than £46bn has been withdrawn from UK equity funds by retail investors, with £24.7bn whipped out in the last two years alone,”

He notes, adding that

“this trend only seems to be accelerating in recent years.”

One of the few bright spots in the UK asset management industry in 2023 was money market funds, which gained £4.1 billion in net inflows. The category, which represents about £31 billion of the total fund market, was the only one to record positive flows last year, indicating that investors preferred keeping their assets in cash during the period.

On the other hand, fixed income funds saw net outflows of £254 million, despite heightened expectations in the second half of the year that bonds would perform well as more investors bet on the end of interest rate hikes.

Money markets saw positive inflows in 2023. Source: Morningstar

The shift from active to passive investing in the UK continued in 2023, as more investors opted for low-cost index funds over actively managed alternatives.

Passive funds saw inflows of £21 billion, while active funds suffered outflows of £46.8 billion. This trend reflects the growing preference for passive strategies among investors who seek to diversify their portfolios and reduce fees.

Blackrock Maintains Lead

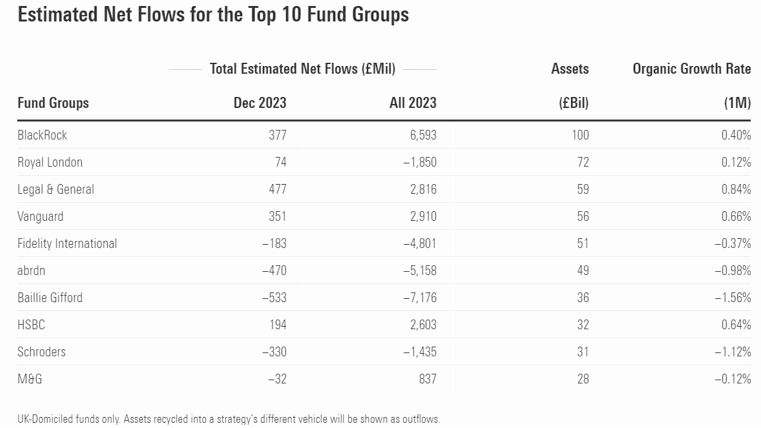

When it comes to the performance of individual asset managers, BlackRock topped the UK fund inflow chart for 2023, with £6.6 billion of new money, pushing its total UK fund assets to £100 billion. Vanguard came second with £2.9 billion of inflows, followed by Legal & General and HSBC with £2.8 billion and £2.6 billion respectively.

Blackrock’s UK- focused funds managed £100 billion in Dec 2023. Source: Morningstar

On the other hand, Baillie Gifford suffered the biggest outflows for the second consecutive year, losing £7.2 billion of assets. Abrdn also faced significant outflows of £5.2 billion, amid its plans to cut 500 jobs and save £150 million by the end of 2024. Fidelity International was the third-worst performer, with £4.8 billion of outflows.

UK Equities Lag US Markets

The gap between the UK and the US stock markets has widened over the past year, as the latter has benefited from a surge in technology stocks driven by artificial intelligence (AI) innovation. The FTSE 100, which tracks the top UK companies, has lost 4.8% of its value in the last 12 months, while the US’s S&P 500 has gained 24%. The performance difference reflects the different sector compositions of the two indices, with the US having a larger exposure to the fast-growing tech sector.

“On the whole, investors looking at their annual statements over the last decade would have seen high levels of growth from their global funds compared to their UK holdings. Little wonder many of them have jumped ship,” says Khalaf.

Khalaf warns that investors may withdraw more money from UK equity funds in 2024 and beyond. This could make UK markets less appealing to firms that want to go public or raise more capital.

“If domestic fund investors won’t invest in UK funds, it’s little wonder the UK stock market is struggling, and so many UK companies are seeking to list overseas.”

A growing number of publicly listed UK firms are considering going public in the US. The US markets offer more liquidity, higher valuations and greater access to capital for UK companies looking to raise funds. As an example of this trend, Cambridge-based chip designer Arm Holdings raised $4.87bn (approx. £3.8bn) on Nasdaq in September, despite strong pressure to list its shares in London.

Overall, the Nasdaq raised $13bn in 2023 while the LSE raised only $972m. The LSE is on track to have its worst year for money raised for companies floating on it since 1995, when Dealogic started collecting data, while the Nasdaq is enjoying a boom in tech listings.

“We’re having a lot of conversations with companies about listing in the US. We get a lot of inbound calls [from the UK] and we also make sure we’re in front of the right CEOs,”

said Karen Snow, global head of listings at the Nasdaq, in an interview with the BBC.

Sustainable Equity Funds Show Promise

However, it is not all doom and gloom for the UK asset management industry. Sustainable strategies have gained a clear edge over non-sustainable ones in terms of attracting investors’ money in the last year. Morningstar data shows that more than £1 billion went into UK-domiciled funds with a sustainability label, while funds without such a label lost £26.9 billion in the same period. This shows a strong preference for investing in strategies that align with environmental, social, and governance (ESG) considerations.

Increased inflows into sustainable equity is not only a UK trend, but also a global one. Investors around the world are increasingly choosing funds that align with environmental and social values. This is evident from the case of Amundi, the largest asset manager in Europe. Last September, the firm announced that it would boost the proportion of sustainable investments in 46 of its ETFs. Some of these funds will see a dramatic increase in their sustainability exposure, from 1% to 35%, or from 10% to 40%. Amundi’s move reflects the growing demand for sustainable finance in the market.

Is Now The Time To Buy?

According to the famous quote by Sir John Templeton, a legendary American-born British fund manager,

“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

This implies that UK shares might be a good investment opportunity, considering the current pessimism around UK-funds. The government is working on post-Brexit reforms to improve financial regulation and make London more competitive with other European financial hubs like Paris and Frankfurt. This could provide a boost for UK stocks.

The global macroeconomic situation also favors UK shares. Central banks around the world, including the Federal Reserve and the Bank of England, have paused their interest rate hikes and are considering rate cuts, which are expected to boost the stock market. This could benefit UK stocks, which have suffered huge outflows in the past few years. However, the decision to buy or not depends on each investor’s strategy and risk tolerance.

Hmmm, I only wish that post-Brexit reforms eventually work out.

Europe is going to have a long decade this time lol